Business Startup Services

Our Business Startup package is our premier service. Following an intake conference with our business attorney, we begin setting up your business, ensuring all legal foundations are in place. This service accelerates your business growth, minimizes taxes with our business strategy, and protects your business assets.

The Basics

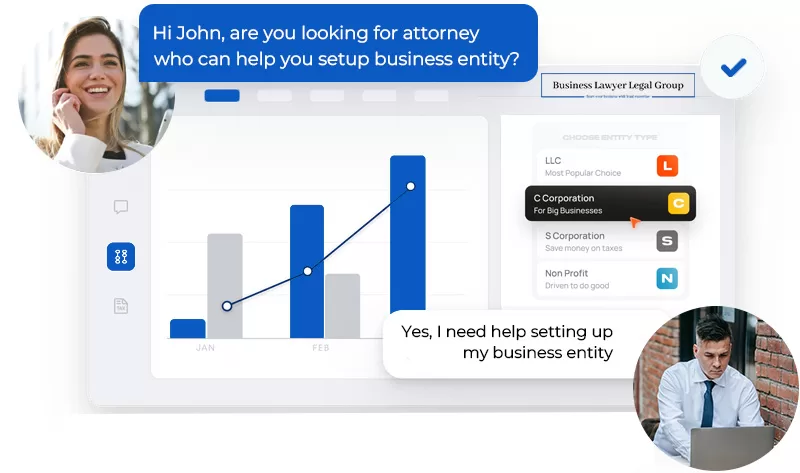

Choosing the right business entity is a crucial step in establishing a solid legal foundation for your business. This decision impacts ownership structure, decision-making processes, financing options, and tax obligations. The correct business entity can provide significant legal protections, optimize tax advantages, and enhance operational efficiency, setting your business up for long-term success.

How We Help

At Business Lawyer Legal Group, we understand the complexities of selecting the appropriate business structure. We created the Business Startup Package to make sure your future business has a strong legal foundation in place to grow and succeed. Our experienced business attorneys will guide you through the process, helping you choose the entity that best aligns with your business goals and needs. We assist in creating and implementing the most effective formation strategy and offer continuous support to ensure your business remains compliant and protected. Review our Business Startup Package below and let us help you build a strong legal foundation, so you can focus on growing your business with confidence.

Most Popular Service: Business Startup Package

|

The Silver Plan |

The Gold Plan |

|

|---|---|---|

|

Intake Business Strategy Conference |

|

|

|

Comprehensive Business Name Search |

|

|

|

Choice of Entity and Tax Structure Conference |

|

|

|

Preparing and Filing of LLC Articles of Organization (Filing Fee Included) |

|

|

|

Preparation of LLC Operating Agreement |

|

|

|

Obtaining Employer Identification Number(EIN) for Business |

|

|

|

Tax Strategy Conference - Tax Deductions, Tax Credits, IRS Audits, Tax Planning |

|

|

|

Obtain Business Credit Strategy |

|

|

|

Business Ownership Reporting to FinCEN |

|

|

|

Customizable Website Powered by WordPress |

|

|

|

Registered Agent Services (1st Year Fee Included) |

|

|

|

Business Workbook - A comprehensive guide that includes all formation documents, operational guidelines, and essential business records. |

|

|

How long does it take ?

Our business attorneys will handle the filing of your formation documents with the Secretary of State.

Typically, approval takes 2-4 weeks from the filing date. Once approved, our team will proceed to complete the remaining legal foundation requirements for your business, a process that will take an additional 2-3 weeks.

After everything is finalized, we will mail you a comprehensive Business Workbook, which includes all your formation documents and access logins.

How much do your services cost?

Our Business Startup Package offers exceptional value with a flat-fee structure, ensuring you receive legal support without any hidden costs. This flat fee covers all foundational legal requirements necessary to establish your business, providing you with peace of mind and allowing you to focus on your business vision.

But that’s not all—we understand that starting a business involves managing many financial commitments. To make our services even more accessible, we offer payment plans.

How does the Business Startup Package process work?

After scheduling a consultation and purchasing our Business Startup Package, our team will set up a meeting with your assigned business attorney. During this initial strategy session, you will have the opportunity to discuss your business needs and address any legal questions you may have about setting up your business. Following this conference, our team will proceed with establishing your business, ensuring it is set up for success.

Order Form: LLC Formation

To proceed, submit your request via the questionnaire. Alternatively, call our office to speak with our business attorneys. Use the "Comments" section for any additional thoughts or information.

Take the Next Step

If you've read this far, you're the kind of client we're looking for. Let's discuss how we can help.